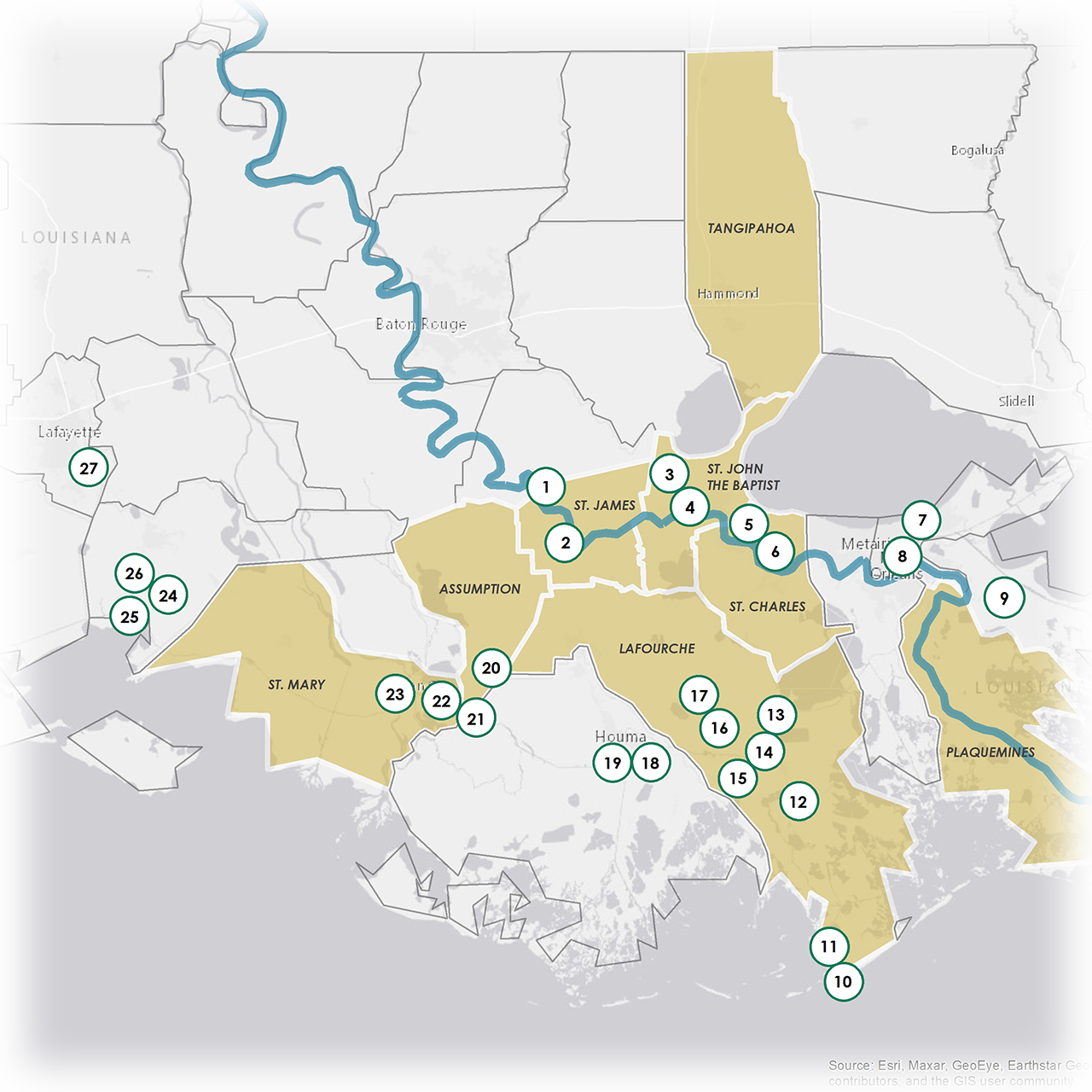

Foreign Trade Zone (FTZ) 124

FTZ 124 ranks #2 in merchandise received and #3 in merchandise exported!

Created in the 1930s by the U.S. government, an FTZ is an area within the United States, in or near a U.S. Customs port of entry, where foreign and domestic merchandise is considered to be outside the country. Certain types of merchandise can be imported into a Zone without paying import duties. Customs duties and excise taxes are due when the merchandise is transferred from the FTZ for U.S. consumption. If the merchandise is re-exported, then no duties or taxes are paid on those items.

Merchandise in a zone may be assembled, exhibited, cleaned, manipulated, manufactured, mixed, processed, relabeled, repackaged, repaired, salvaged, sampled, stored, tested, displayed, and destroyed.

Subzones

Two subzones -Globalplex and Castleton Commodities International, LLC- are part of

FTZ’s ALTERNATIVE SITE FRAMEWORK (ASF), which simplifies minor boundary modifications to their designated location.

Activity at U.S. Foreign Trade Zones [2022]

Foreign Trade Zone Board’s 84rd ANNUAL REPORT TO CONGRESS [2022]

– $1,011B in merchandise received –

– $387B in warehouse/distribution –

– $94B in exports –

– 500,000 jobs supported –

Production, defined as an activity involving the substantial transformation of a foreign article or activity involving a change in the condition of the article which results in a change in the customs classification of the article or in its eligibility for entry for consumption, must be specifically authorized by the FTZ Board.

For more information, contact TED KNIGHT, visit U.S. FOREIGN TRADE ZONES BOARD’s ENFORCEMENT and COMPLIANCE, or click on the links below.

RESOURCES:

- Why Foreign Trade Zones are Important to the Oil Refining Business in the U.S.

– National Association of Foreign Trade Zones. - Advantages of Foreign Trade Zones

– Miller & Company, P.C. - Foreign Trade Zone Service Providers

- Foreign Trade Zone Savings Analysis Worksheet for Manufacturing / Warehousing / Distribution

– Miller & Company P.C. - Foreign Trade Zone Costs

- Foreign Trade Zone #124 Zone Schedule